Free cash flow margin formula

This is helpful in comparing the free cash situation of different companies on an. Gross Margin for 2020 Gross Margin for 2019 Thus the.

Free Cash Flow Formula Calculator Excel Template

Examples of Free Cash Flow Margin in a sentence.

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals. April 1 2022 by kumara Liyanage.

Cash Flow Margin Definition. Net profit margin Revenue cost revenue. The formula for calculating free cash flow margin is.

The higher the percentage the more cash is available from sales. Cash Flows from Operating Activities is basically free cash. So how does the cash flow margin formula work in practice.

Step 3 Divide Operating Cash Flow by Revenue. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. The Free cash flow margin is a measure of how efficiently a company converts its sales to cash.

A company that shows an. Cash Flow Margin Cash Flows from Operating ActivitiesNet Sales. Calculating free cash flow reveals how much your company must spend on day-to-day operations.

Based on FY22E Revenue Growth Free Cash Flow Margin guidance of at least 32 in preliminary results released on August 12 2021. Step 1 Calculate Cash Flow from Operating Activities. Cash flow margin is a measure of the money a company generates from its core.

Its relatively straightforward so heres a cash flow margin example to shine a light on the practical applications. To determine your free cash flow subtract the. Calculating the OCF margin is a four-step process.

Free cash flow formula. Cash flows from operating activitiesnet sales _______ percent. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures.

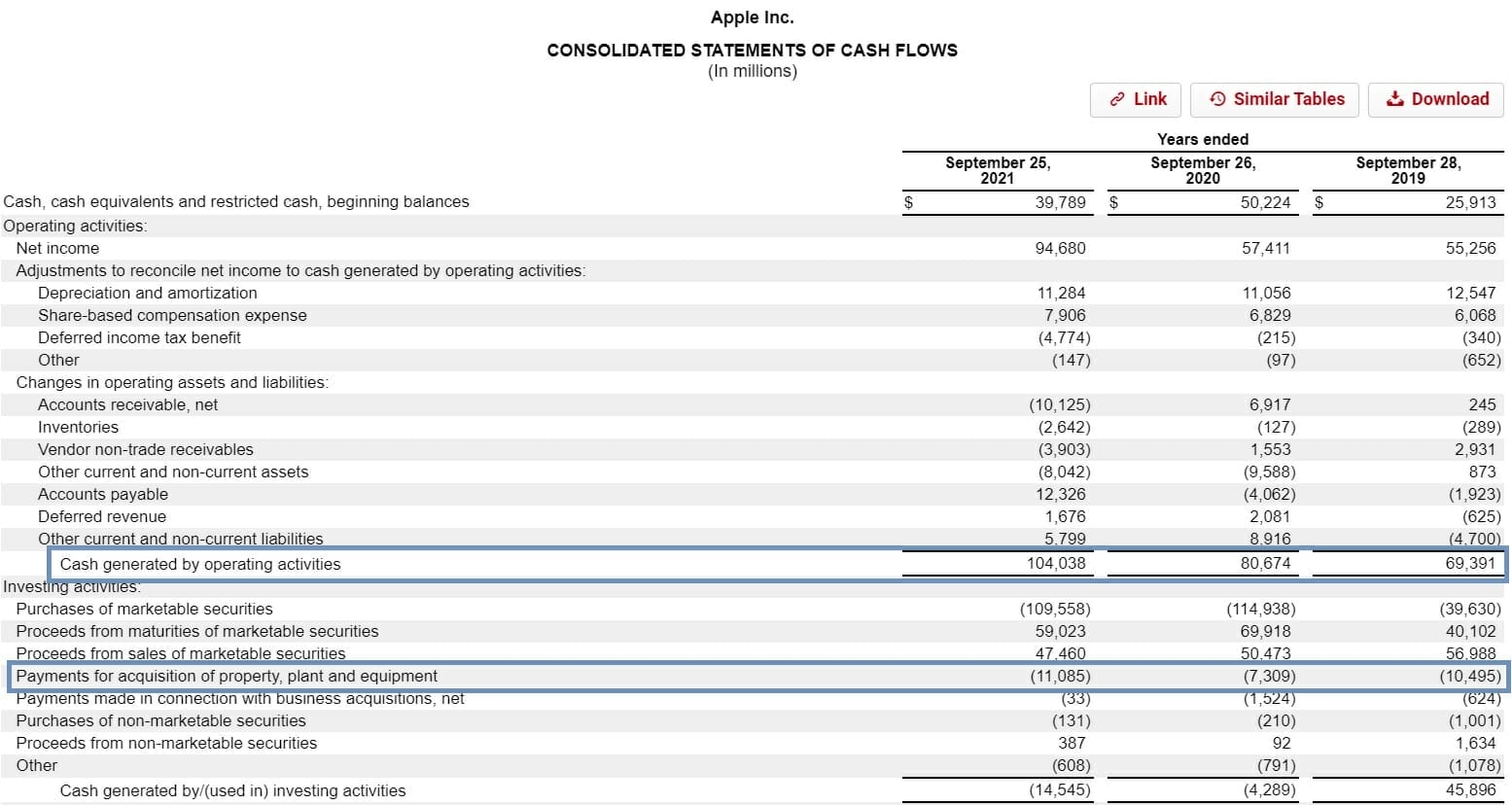

The Cash Flow Margin Calculator is used to calculate the cash flow margin. Gross Margin for 2021. The operational cash flow margin of your company is an essential.

The higher the percentage the more cash is available from sales. Free Cash Flow Yield. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Operational leverage This term refers to how a business owner can increase their operating income via increased revenue. Step 2 Calculate Net Revenue. Accordingly the Gross Margins for Salesforce Inc for the years 2021 2020 and 2019 are as follows.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. Free cash flow margin simply takes the FCF and compares it to a companys sales or revenue. Calculating the Operating Cash Flow Margin of Your Companys Operations.

The cash flow margin is calculated as. Operating Cash Flow Margin.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow Efinancemanagement

Operating Cash Flow Margin Formula And Calculator

Operating Cash Flow Ratio Definition And Meaning Capital Com

Free Cash Flow Conversion Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Operating Cash Flow Margin Formula And Calculator

Operating Cash Flow Margin Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Defining A Good Fcf Margin Formula Basics Examples And Analysis

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Cash Flow Formula How To Calculate Cash Flow With Examples

Unlevered Free Cash Flow Definition Examples Formula